This is one of the few bonuses that allow players to bet on multi bets with their bonus funds. Based on our tests and research, the top four betting sites in Nigeria are Bet9ja, Paripesa, 1xBet and Betway, in no particular order. Bet9ja, a sports betting website, is the third most-visited website in Nigeria with over 66 million monthly visits, 94.29% of which comes from within Nigeria. Roulette is part of that type of games called game of chance, that is, games of chance. Winning, in these cases, is not so much a question of skill, perhaps refined over time, but of luck. There are, therefore, no proven tricks to increase your chances of winning.

Top Payment Methods

Anbessabet also has options for cash deposits through the use of CBE Birr, Hellocash, Amole, CBE, Wegagen Bank, Coop Bank, among others. Bet994 brings an easy way to wager and enjoy betting in Ethiopia. You can bet on all Sports, Play Virtual and Aviator Games and Jackpot.

The Rise of Mobile Betting in Africa

Click the “Sports” link to open up the bookie section of the site. You can use these to access specific types of events that you want to bet on. Payment methods include AstroPay, MasterCard, Jeton, Neteller, and Skrill.

- It will not only enable you to master the registration process but also enable you to claim a bonus of up to $100.

- The tax is automatically deducted from your winning payment, hence no further declaration of such values is required.

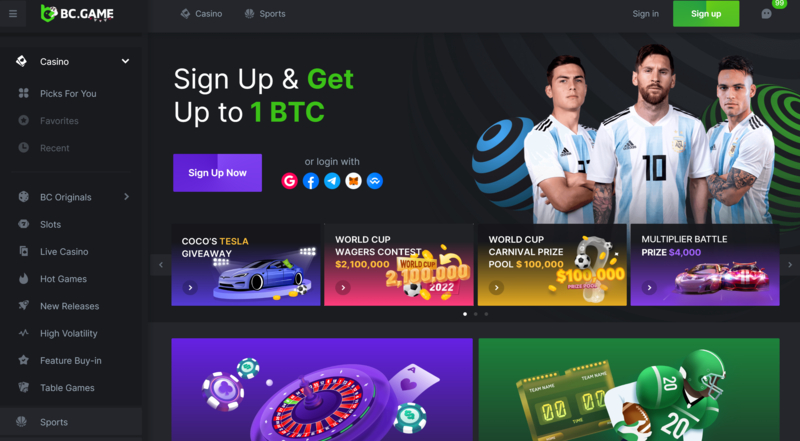

- BC.Game has earned a commendable reputation among global cryptocurrency aficionados.

- Senegal will play against DR Congo, Botswana, and Benin Republic in the group stage.

- Mobile betting is the prevalent option among punters to place bets on their favourite sport, football.

- Like I said before, it depends entirely on what kinds of sports you prefer to bet on, how you like to bet, what interface you prefer, etc.

- After downloading, change your phone’s security settings to allow installation from unknown sources.

Sportingbet Sign Up Bonus

Betting odds directly impact the amount of money you stand to win, meaning they are of utmost importance. Live streaming refers to the provision of coverage of sporting events by some betting sites. You can go ahead and watch events as they happen, which can be an incredibly helpful tool in informing your betting strategy. You have plenty of options in certain events, so if you’re looking for more markets, click on the more bets option. Our method is simple, choose the factors that are most important to you, test out some betting sites, and find the one that offers what you’re looking for in the best way.

Gmitbet Sport Betting

A website, whether it is an African sportsbook or any kind of site, is often only as good as the experience that it provides. This user experience is dictated by the ways in which the site is designed. Some African sportsbooks, naturally, are bound to provide more intuitive, dynamic, and responsive site design than others. Some sportsbooks are neat, clean, and easy to use; whereas others may be cluttered, hard to navigate, and confusing. The best African sportsbooks are the ones that make it as easy and simple as it should be to find and place precisely the kinds of bets that you are looking for.

- Originally, the National Lottery Administration only operated as a conventional lottery responsible for lottery games within the country.

- New players here get the ultimate welcome bundle – 2 no deposit bonuses and 1 deposit match.

- BetKing offers the largest welcome bonus of up to 1 million in free bets when you sign up using our promo code BETMAX.

- The biggest markets in the industry are currently in Kenya, Nigeria and South Africa.

- Bettors can enjoy everything from matchday wagers and accumulators to outright winner bets, all available through leading South African sportsbooks.

What sports can you bet on?

Some online sportsbooks allow customers to bet on 30 or 40 different sports. If a sportsbook has a history of mismanagement or ripping someone off, I will make it known in my reviews. So long as you go through each and every one of my best sportsbook reviews, you will know precisely what you are getting into before you ever make your first deposit. I am hard at work each and ever day to make sure that, together, we hold sports betting sites accountable and make online sports betting the best experience that it can be.

South Africa’s Online Gambling Crisis: Weak Enforcement Undermines Government Authority

The form of gambling is on a hasty incline, and the major operator with the most customers is PremierBet. Also, mobile betting is a common option for the people of Tanzania. Sports betting is a growing industry in Africa, and it has become a part of many Africans’ daily lives.

Certain bookmakers will exclude regions or countries from promotions, so it is always worth reading the fine print before creating an account. The best sportsbook in Africa boils down to preference and it being licensed. Nonetheless, the top sportsbooks are 1×Bet, BetPawa, Betway, MelBet, Paripesa, and PremierBet. Dear user, this sportsbook has a problem with registration and money withdrawal. When you input you ID you are probably going to be noticed that this ID has already been taken. Choosing a betting site is never easy especially with there being so many bookies on the South African market.

How to Choose the Best Bookmakers in Africa

We recommend comparing most recent terms and offers before making a final decision to ensure that you receive the best possible value. Playabets particularly excels in withdrawal processing, where players are often paid out their winnings in as little as a few minutes after requesting withdrawal. Along with my dedicated team, we have spent weeks trawling the very interesting South African online betting industry to provide you with all the need to know betting information. Mobile experience, similar to user experience, is a very subjective factor.

Betting Markets

Despite the economic benefits, there are የስፖርት ቤቲንግ concerns regarding the potential for gambling addiction and its impact on individuals and families. Educational initiatives and support systems are essential to address these issues. Explore an informative video tutorial of a step-by-step guide to registering at 1XBET. It will not only enable you to master the registration process but also enable you to claim a bonus of up to $100.

Match Results and Statistics

You can also check out our page on online casinos for our recommendations on where to play your favourite games. Sports betting in Ethiopia is more than a pastime—it’s a passion that captures the essence of sports enthusiasts nationwide. With the advent of digital platforms, this age-old tradition has found a new lease of life, merging the fervor of sports with the anticipation of a win. Finally – and most importantly – we only list trusted bookies which are licensed by one of the official licensing bodies in South Africa.

Some will offer tens of rands, while others will give you hundreds. To create a competitive advantage over each other and establish uniqueness, each bookie has a unique approach to offering the welcome offer. Consequently, this makes it possible to have all sorts of welcome bonuses. 10bet Bookmaker welcomes its new South African players with a wonderful bonus. To activate the welcome bonus, head to your account section and click on Bonuses. Click on Sportsbook on the menu and then the ‘Claim Bonus’ option.

Is there an Afrobetting bonus?

I hold African sportsbooks to the same high standard that I apply to any sportsbook from anywhere in the world. The sites that make it through my rigorous tests are the ones that I then list and review. If I even sense a scam or an illegitimate quality of a sports betting site, well, it certainly does not belong on this list of the best African sportsbooks.

The future of Afro sport betting looks promising with continuous technological advancements and increasing acceptance. Innovations like blockchain technology, virtual reality, and artificial intelligence are set to revolutionize the industry even further. The Bet Constructor is a feature that allows you to create personalized bets by combining multiple outcomes into a single wager. This tool is convenient because it gives you the flexibility to craft custom bets that suit your preferences and betting strategy.

- Online sports betting has been booming over the last few decades, largely thanks to the advancements in technology and accessibility of the internet across the continent.

- 1-click mobile access to Bet.co.za if you add a shortcut of the site to your smartphone.

- Welcome to Bet & Win, your comparison site and review guide for the best and most popular sport betting, lucky numbers and casino games sites in South Africa.

- Aside from the deposit online casinos offer, some sites have exclusive perks in the form of golden chips.

- There’s a minimum and maximum deposit for each method so be sure to look through the cashier page to get more details.

- You can be assured that everything from the bookies registration process to their welcome bonuses have been thoroughly investigated by our team.

We’ve played the angles to make the list of South Africa best betting sites providing excellent services even to picky punters like you. Other covered sports at AfricaBet Zimbabwe include baseball, basketball, tennis, handball, cricket and rugby. For all of these sports, punters are guaranteed to choose from a wide variety of betting markets for each event. All of the offered betting markets come with impressively high odds. Aviator is both easy to play and thrilling to bet on, putting you in control as you try to win some of the largest payouts possible.

Finally, we provide you with a trustworthy test report that covers the betting sites that are approved in the respective countries. Our experienced testers take care to remain as objective as possible. The legal situation regarding gambling in the respective countries and the respective approvals are essential prerequisites.

Many things make these promotions in South Africa special, one of which is the fact that these offers are regularly available. Instead of using a specific site just ot access this perk, gamblers in SA will find no top-up perks all over the place. This is a huge plus because users have the freedom to choose more options. If you are looking for an online casino bonus no deposit, there is a good chance you will find a deal that grants you bonus cash. These are the most common rewards that do not require any money transfer and are available worldwide.

SimplePlay launched new Table Game: “Number King”

Africa is home to some of the most exciting and competitive sports leagues in the world. However, other sports such as athletics, rugby, and cricket are also gaining traction. I’m Alex and I’ve made it my mission to present to you the best betting sites in South Africa, as well as how to choose them, how to use them, and much, much more. The final step in this amazing adventure into all things bettings sites is withdrawing with them. The process is fairly simple given that you have had your FICA documents approved, and have winnings to withdraw. The process involves uploading or sending ID and Proof of residence documents to betting sites.

Africa Re Celebrates Industry Excellence and Youth Empowerment at the 2025 African Insurance Awards

Get in on the action with soccer betting, rugby betting or one of the many other options available. Responsible Gambling Betting should be an entertainment, not a solution to financial problems. If you or someone you know is struggling with gambling, please seek help from local support services. The right welcome offer is one of the most important initial factors to consider when you sign up. And this is the point where our visitors possibly rely on us the most. We let you know if a certain offer is fair by evaluating welcome bonuses and the respective terms and conditions.