Attorneys are cautious when structuring private mortgage loans, specifically making sure that the fresh mortgagee gets ideal protection more than the borrowed funds

A beneficial “private” mortgage is but one extracted from an individual or entity which is none a lender placed in Plan We or II on the Financial Work, S.C. 1991, c. 46 (Canada), an authorized insurer, a subscribed mortgage loans Rosa otherwise trust agency, a subsidiary of any of those, a pension fund, or other entity that gives money in the standard span of their organization. Personal money extracted from a buddy or a close relative is oftentimes the cheapest source of resource. The reason being these bank will normally lend within a lower life expectancy interest rate as compared to market price, will not charges broker or appraisal costs, and does not request mortgage insurance rates. Also, generally speaking just one attorneys could possibly get operate for the lender and also the borrower, that will cut the brand new debtor the other expenses active in the replication regarding judge charge. First of all, an attorney (or several solicitors practising within the relationship otherwise connection) can operate for both debtor and you can financial within the a great home loan otherwise financing exchange only where:

– the lending company and borrower commonly at hands size as the defined regarding the Income tax Act, (R.S.C., 1985, c. 1 (5th Supp.)) (Canada).

For the affairs involving private money-and especially in which the buyer’s lawyer acts towards the personal bank too-the most important thing toward attorney to determine the exact judge identity of the mortgagee, the region of the financial part from which your order commonly getting undertaken, while the brands of every required get in touch with someone for both the lender additionally the bank. Even if less than equitable principles a legal look beyond the function off a device to search for the aim of the new functions, it is vital to ensure that the deal comes with the perception away from establishing a security, unlike a complete business in the form of a complete conveyance (find, such as, Oland v. McNei1). On top of that, no matter what style the parties’ arrangement usually takes (if just like the an outright conveyance or otherwise), the new parties’ intent to produce a protection tends to be established due to the application of evidence: find Wilson v. Ward.

Although not, the scenario of an individual lawyer acting for both lender and borrower might possibly be subject to tight Law Society directives

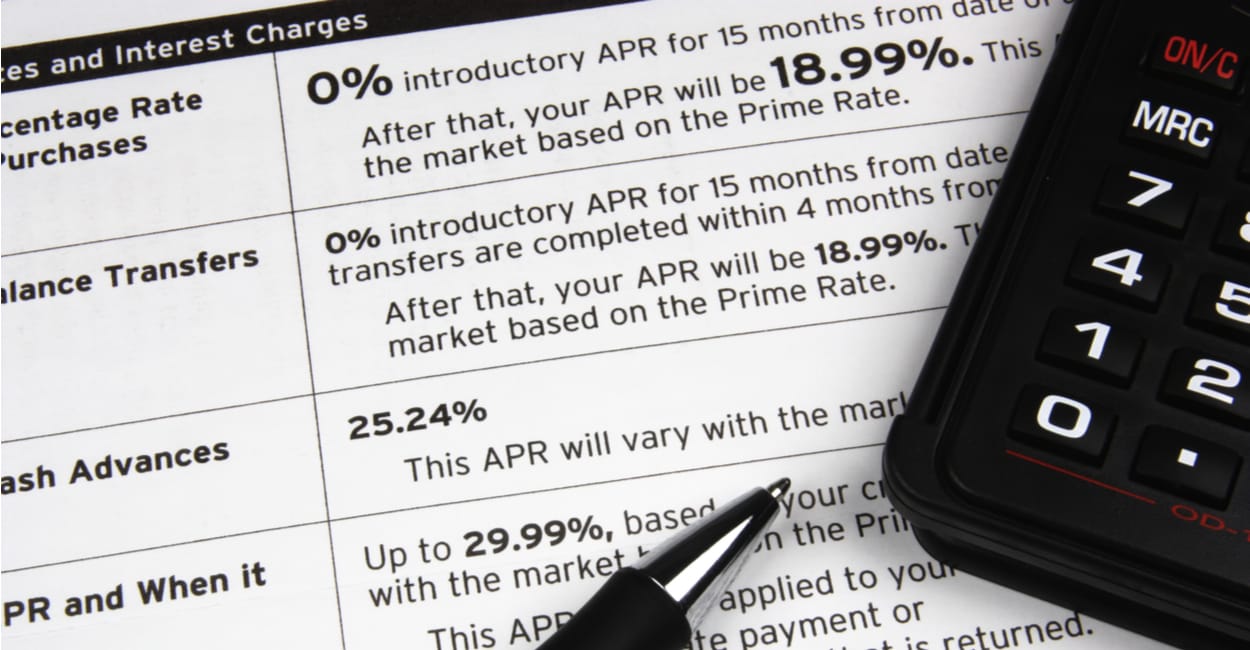

A large financial company could be able to strategy personal money. not, the fresh new debtor are expected to invest each other brokerage charges and you can appraisal can cost you, rendering it method of resource perhaps one of the most expensivemission and you may appraisal charge are payable ahead and are not usually refundable in the event the exchange isnt completed. Various other hours, these types of costs are subtracted on the number of the borrowed funds improve to your closing. Hence, because borrower ount regarding prominent towards the closing, he or she need certainly to estimate money essential for closure accordingly. Additionally, in the event the representative or perhaps the private bank claims to the using his otherwise her very own attorney, this new borrower was guilty of percentage of one’s broker’s otherwise lender’s lawyer’s charge, and borrower’s own lawyer’s fees. Mortgage brokers are presently managed of the Home loan Brokerages, Lenders and you may Directors Operate, 2006, hence replaced the loan Agents Work, active . Home loans licensed beneath the MBLA usually are able to receive financial financing of these those with not eligible for financing courtesy institutional lenders. The loan rate is generally high for the majority of reasons, including the risk in it. Lower than areas 6 compliment of nine of one’s Cost of Borrowing and you can Disclosure so you’re able to Individuals Regulation, under the MBLA, mortgage brokers must provide borrowers having a composed disclosure declaration explaining this new conditions and various other certain areas of the fresh home loan. The mortgage might possibly be rendered incorrect if for example the broker does not get it done: look for Serm Opportunities v. Forrest, where in actuality the court held invalid a mortgage inside an incident where the requirement statement was not considering, discovering that this new mortgagors got prejudiced. Immediately following a borrower possess install to own financing due to a large financial company if not, brand new attorneys performing on your order is required to recommend with the, or take the necessary safety measures to the, the safety away from his or her client’s interests. For the Rabi v. Rosu, the Ontario Advanced Court off Fairness said into unpassioned nature of modern-time mortgage lending and credit, stating that in the event before it, way more proper care need come worked out due to the fact an amount inside excess of that-one-fourth of a million bucks was being advanced.