Many people conserve for many years and have making sacrifices in the act. It is significantly more tricky getting unmarried parents who’re supporting youngsters.

Save a huge deposit

So it sounds obvious but setting aside as much money as you can setting you have got much more equity in the assets you need to find, definition it’s not necessary to obtain as often.

If you are less than forty and wish to purchase your earliest family, opening an existence ISA will provide you with up to ?step 1,000 off 100 % free money every income tax seasons. Here is how the newest Lifestyle ISA works.

Hire a mortgage broker

An effective mortgage broker will be able to help you decipher and that lenders are likely to offer you a home loan.

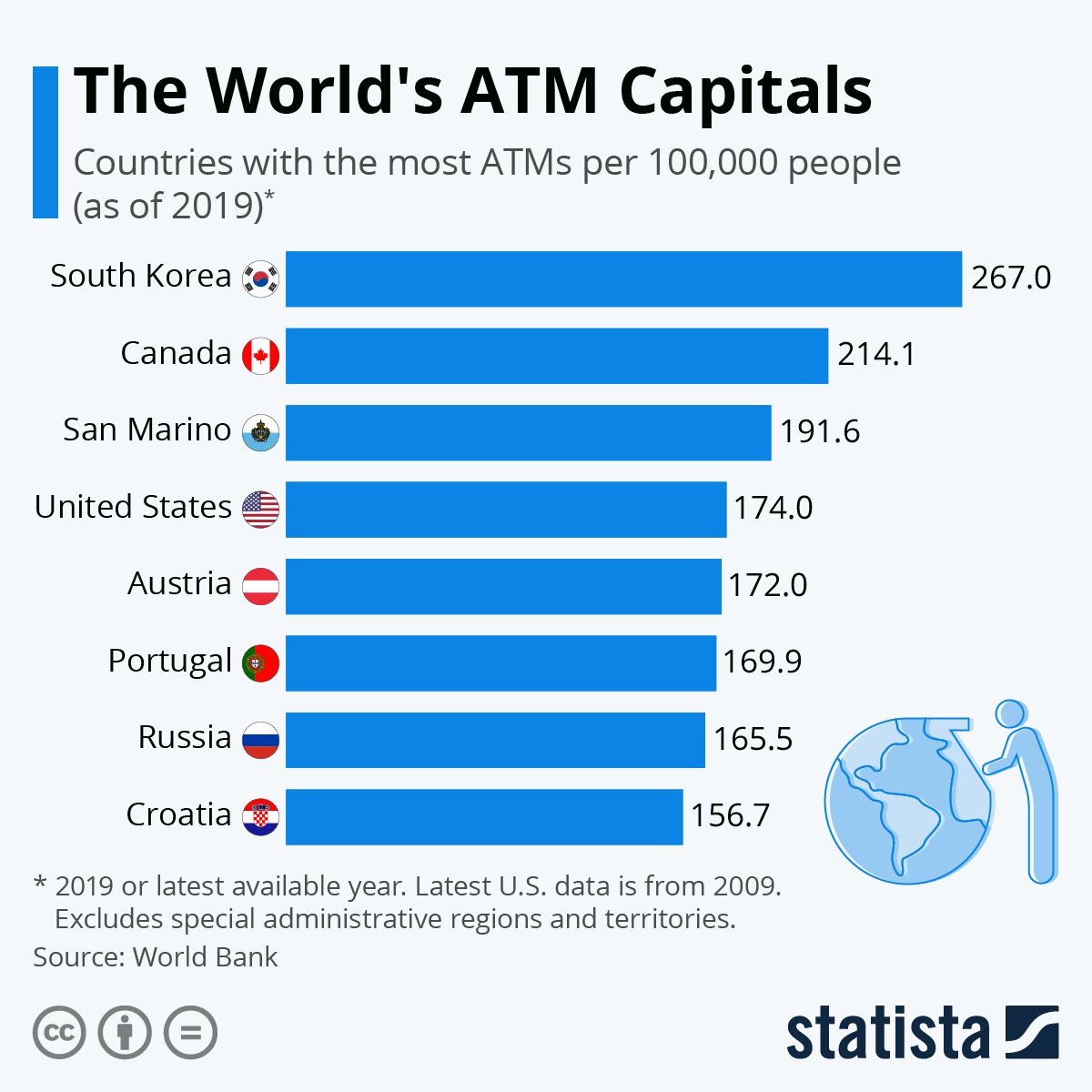

Clearly regarding dining table more than, loan providers need an extremely additional stance exactly how they calculate specific form of income.

They’re able to plus hold their give through the mortgage process which is priceless, particularly if you happen to be a busy operating mother or father.

If you are weighing up whether or not to hire a brokerage, check out this. Remember you can find 100 % free home loan advisors too. loans Glastonbury Center We checklist the major-rated of these right here.

Fool around with a federal government scheme

Common ownership will work for men and women just who can’t afford so you’re able to take on a giant mortgage. Which program lets them to pick a portion of the property and you may pay rent into the other people.

People pick a percentage out of between twenty five% and 75% of the property’s worth. Be aware that you still have to save a deposit into mortgage.

- To find aside their ex lover-spouse (on one here)

- Taking up a complete mortgage repayments

- All domestic costs

The lending company needs to be satisfied you to modifying the borrowed funds from mutual brands to just one you to definitely continue to be affordable, which is where lots of unmarried mothers find difficulty.

David Hollingworth regarding L&C mortgage brokers told you: Affordability is the vital thing matter. Even with an understandable want to stay in the current family home, it might not be possible regarding long run.

Possessing the household family may require both ex lover-partners to remain towards the mortgage, though singular of those continues to alive there. However, this always is not possible sometimes as the people wouldn’t wish to be named toward a home loan while they are no stretched surviving in a home.

It can also be challenging and more expensive to pick an effective home while are named on the an alternative due to the fact theoretically you’d be to buy another assets. This means that, lenders would need to determine your earnings over a couple mortgages.

Because of this, Hollingworth said ex-people tend to ily the home of discharge guarantee to every partner, giving them each other a deposit into the an alternate property.

But that can maybe not get rid of the affordability tension on a single father or mother, which is why Hollingworth told you its more important than in the past so you can make certain normally income as you are able to is going to be factored directly into support the financial.

It certainly is smart to be certain that you’re providing advantage of any possible deals to ease brand new financial load, such as because the family members are wading due to a repayment from life style crisis.

Council tax write off

There can be a twenty five% council income tax disregard available to those who either alive alone or that happen to be the only mature surviving in their home.

Which have council tax expanding in the most common towns and cities within the British, be sure to take advantage of this to save oneself numerous out-of lbs over per year.

Youngster work with

Make sure you are stating the money to have child work for, that gives you ? weekly for your first youngster and you can ? for everyone most youngsters.