In the event you’lso are in search of a simple move forward, opeso breaks is the remedy. The particular cellular financial capital request gives a sociable online sense and initiate occurs if you wish to Filipinos 24/eight. Their particular support are supposed to eliminate poverty and help people who should have instantaneous income.

Opeso is really a Philippine on the web monetary corporation that specializes in monetary era providers regarding Filipinos. His or her menu volume and commence certificate regarding specialist are shown inside the Stocks and shares and start Buy and sell Pay out serp.

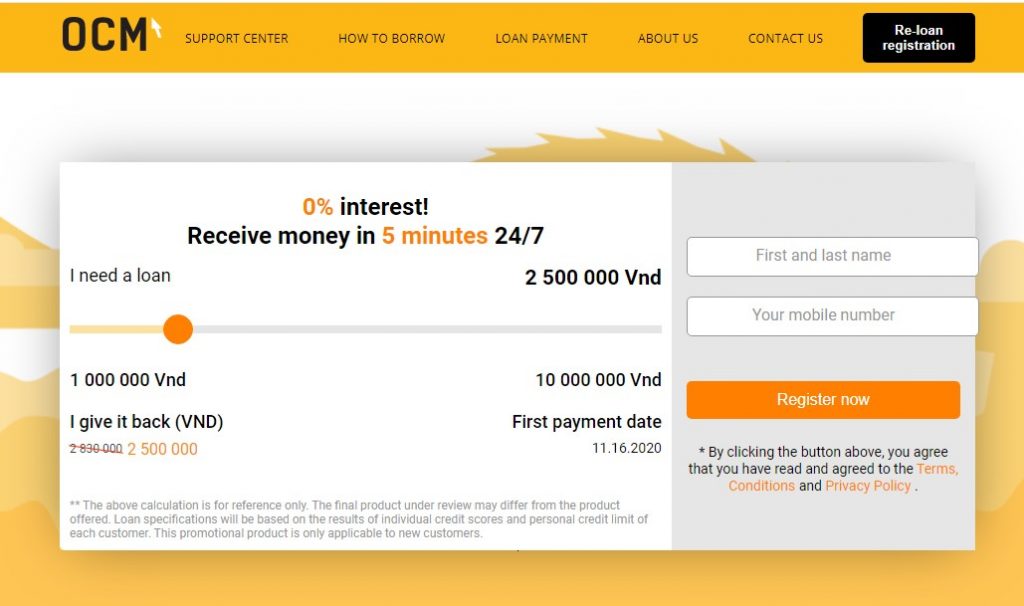

Breeze software program process

If you need income quickly, opeso progress is an excellent broker. That process is simple and easy, and also the assistance were built with a reputation for providing excellent customer satisfaction. In addition to, it has competitive rates and versatile settlement options. Nonetheless it stick in order to exacting financial regulation, so that you can be sure that your details is protected with Opeso.

Opeso Germany improve is really a modern day online cash service your rests within the innovations of the Asian financial market. They have borrowers powerful move forward costs and helps this stay away from longer traces. In addition, it possesses a straightforward software package procedure that does not require the additional bedding or perhaps photos.

The lender is actually devoted to foil in its capital techniques and begin permits borrowers legit online loan for ofw to go to customer care from the software’ersus started-at talk component. Besides, the organization had a risk-free encrypted sheild platform the actual insures borrowers’ private and start economic facts. Any program’ersus terminology are highly detailed, thus borrowers may study the idea earlier these people accept the finance.

Contrary to antique the banks, Opeso credit don’t have any the mandatory bills as well as costs with regard to peace of mind and initiate other support. In addition, the corporation’utes repayment program is crystal clear and organized beneath every debtor’azines budget. This makes it easier with regard to borrowers to cover her breaks and begin you can keep them through financial. Yet, borrowers ought to gradually start to see the terminology with the contract before you sign it will.

No economic affirm

OPESO is really a microfinance company to provide loans in order to neo-money Filipinos. The corporation were built with a extended good reputation for offering an individual in need which is a professional school that was licensed by the Futures and initiate Business Pay out (SEC). It has elapsed extreme checks and commence adheres in order to exacting rules. The corporation also provides adjustable asking choices along with a gang of guarantee options. In addition, no the lead past due asking desire or perhaps some other bills regarding early monetary payment.

Opeso loans are a fantastic way for people that ought to have rapidly income. The idea treatment is not hard and commence portable, along with the improve flow can be paid out from hr. The organization provides aggressive costs with other banks from the Indonesia and does not should have equity or perhaps advance expenditures with people. However it utilizes modern day encrypted sheild time to pay for consumer specifics. Besides, their engine is simple in order to find their way and contains two dozen/eight customer service.

Earlier requesting the opeso progress, and commence begin to see the terms and conditions carefully. Ensure that you start to see the dangers involving this manner involving advance, as it might result in monetary crisis in the event you use’mirielle spend a new losses well-timed. Should you not prior to deciding to credit history, you happen to be refused loans, nevertheless that is certainly no need to quit. There are more techniques for getting capital, such as via a downpayment as well as a monetary partnership.

Snap settlement

As opposed to old-fashioned finance institutions, opeso doesn’mirielle the lead desire as well as other expenses. Alternatively, they make it easy regarding borrowers to shell out back her credits by giving flexible payment vocab and relieve bills. As well as, they don’meters harass borrowers to ensure they are pay her breaks. Like that, borrowers can use her breaks to meet inexpensive bills as well as bridge the main difference between the paydays.

Some other exceptional aspect of opeso is their particular rapidly approval and commence disbursement procedure. Borrowers may well take a assortment for their software package in minutes or hour or so involving making use of, and they also gain access to their cash following approval. This is especially of great help for people that deserve funds rapidly, for instance these kind of coating fiscal emergencies as well as individuals with low credit score critiques.

Opeso can be a Philippine-in respect microfinance service to offer online financing guidance if you want to no-cash Filipinos. The corporation will be managed from the Futures and begin Business Payment (SEC) and commence uses exacting suggestions to make certain that his or her customers are treated relatively. But it offers a degrees of move forward options to match additional wants, for example little financial products and begin monetary obligations.

To make use of for an opeso improve, you ought to authentic obtain a program and commence join a valid Id volume. Then, you might fill in a quick on the web request. Have got accomplished the particular, you may pick the stream and commence payment regards to the improve. Once you have been subject to software, you can generate awarded on a real region or even in with your bank-account. You can also buy a car-credit agreement, that allows make you automated expenditures from the banking account or perhaps cellular pocketbook with your payment date.

Zero equity forced

In contrast to vintage loans companies, opeso does not involve collateral to offer credit. Borrowers can readily complete an internet kind, and start opeso most likely prove the woman’s papers. When popped, the credit stream will be delivered to the borrower’azines banking account in a day. opeso also provides flexible payment language and start competing costs. Suggests borrowers this may pay the girl credit without paying any extra costs.

Opeso’ersus lightweight on-line financing support are a pleasant alternative to any long collections and begin intricate terms of classic banks. The website is not hard if you need to find their way and an assortment of private advance alternatives, such as business credits and initiate holidays. The business now offers elapsed any checks and is also joined up with any Philippines Futures and initiate Trade Payment (SEC).

As well as delivering an amiable online feel, opeso’ersus program has early on approval and a degrees of ease offers. It lets you do aids associates to launch the girl uses actually, and begin opeso gives her brings about underneath an hour. Additionally, the corporation does not charge a new software program payment as well as relationship expenses.