How To Make Money In Intraday Trading

Through its unbiased approach of dissecting the prevalent challenges and finding ways for small investors to make money in the market, IPO Central aims to help individual investors in starting their stock market journey in a surefooted way. 25, you’d incur a loss. Depending on the stock broker’s software, you can get multiple types of trading charts. The user assumes the entire risk of any use made of this information. You can track your expenses in real time and access the data throughout the year whenever you want. International Securities Exchange ISE is an electronic options exchange located in New York City. When compiling the best investment platforms for stock trading, we considered pricing, available investments, account types, and investment research resources. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. Now that we have laid the groundwork and you are aware of the pros and cons of this type of trading, let’s get into the specific 1 minute scalping strategies you need to know to make the most of your trades. The algorithms used in financial trading are rules or instructions designed to make trading decisions automatically. Trading on margin, ie opening a position for less than the total value of your trade, is also known as a ‘leveraged’ trade. An indicator that allows traders to measure the size of price movements which, in turn, suggest how volatile the market may be in the future. Fidelity offers a variety of account types outside of normal taxable investment accounts, like you find at Robinhood. Repay margin loan: $5,000. It’s helpful to break securities and asset traders into two categories: long term investors and short term traders. Price levels: The best thing to do is to set price targets and stop losses for every trade. The returns from a scalp based strategy depend on the capital deployed, position sizing and the overall logic of the strategy. In this way, the covered call writer collects the option premium as income, but also limits the upside potential of the underlying position. This can include supplements, skincare items, or fitness equipment, helping customers achieve their best look and feel. But for those who are just beginning their day trading journey, this article will explain the key steps to getting started and explore 10 day trading tips for beginners—from setting aside funds and starting small to avoiding penny stocks and limiting losses. Even though we master the intraday trading strategy, the monetary reward earning is difficult and is possible only if you have patience and discipline. The trader makes $60 $100 – $40. If the investor uses a stop limit order, when the stock falls to the stop price, it’ll trigger an order that seeks to fill at the limit price or better. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill that could potentially supplement your longer term investments. The online broker is extra convenient for Chase users. On Angleone’s secure website. Com’s comparison testing. Account Maintenance Charge.

Intraday Trading Tactics for New Traders

The most common underlying securities are equities, indexes or ETFs. Once there is a price change, the momentum changes in a different direction. Option types commonly traded over the counter include. These models describe the future evolution of interest rates by describing the future evolution of the short rate. New clients: +44 20 7633 5430 or email sales. Investment app providers need this information so they can adhere to federal regulations and make sure you’re investing as safely as possible. However, it’s worth noting a cliched dictum of the financial world: past performance is no guarantee of future results. Sign Up for My Free Weekly Trading Tips Newsletter. Investors can purchase options include equities, indexes, debt securities and foreign currencies, the focus here is mainly on equity and index options. I also go through a predetermined checklist of attributes that include. Mindset play significant role in trading psychology as it acts as the critical lens shaping all elements of trading psychology. Although if you’re using it on mobile and click on someone’s profile you can’t go back as there isn’t a go back button so you lose where you were or which comment you were reading and have to start from top of the news page etc. 6 – 14 Day Trading Strategies for Beginners – Go Banking Rates. Please conduct due diligence and read reviews prior to investing. This includes the platform’s Perpetual Futures Contracts, which allows you to apply leverage. In some cases, the buyer takes physical delivery and delivers cash, but many futures contracts specify that they’ll be settled with cash only, not with delivery of the good. The role of a demat account is to store shares electronically, and a trading account is to enable buying and selling of shares in the stock market. However, trading https://pocketoptiono.website/en/about-us/ in general is inherently risky, and copy trading is no different. You must enter the OTP that was received from the trading app to your registered cellphone number after providing all the necessary information. Consequently, you must decide on the criteria that a stock must meet before you can buy it. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. What’s great about our Forex VPS is that you don’t have to use your personal computer’s resources for trading; you will have a fully functional virtual space to execute all your trading orders without a glitch. These provide a range of services, tax efficiencies and investment options. If you are already a registered user of The Hindu and logged in, you may continue to engage with our articles. This report does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. I’d rank Global Trader above many apps from beginner focused brokers. Now, read why we like ETRADE and learn how the rest of our winners might be best for you. We want to clarify that IG International does not have an official Line account at this time. With Neostox, NSE virtual trading becomes a tool for success, preparing you for the real action. Offering a solid range of coins with low fees, Kraken is well suited for beginners.

What are the trade timings for Commodity Trading?

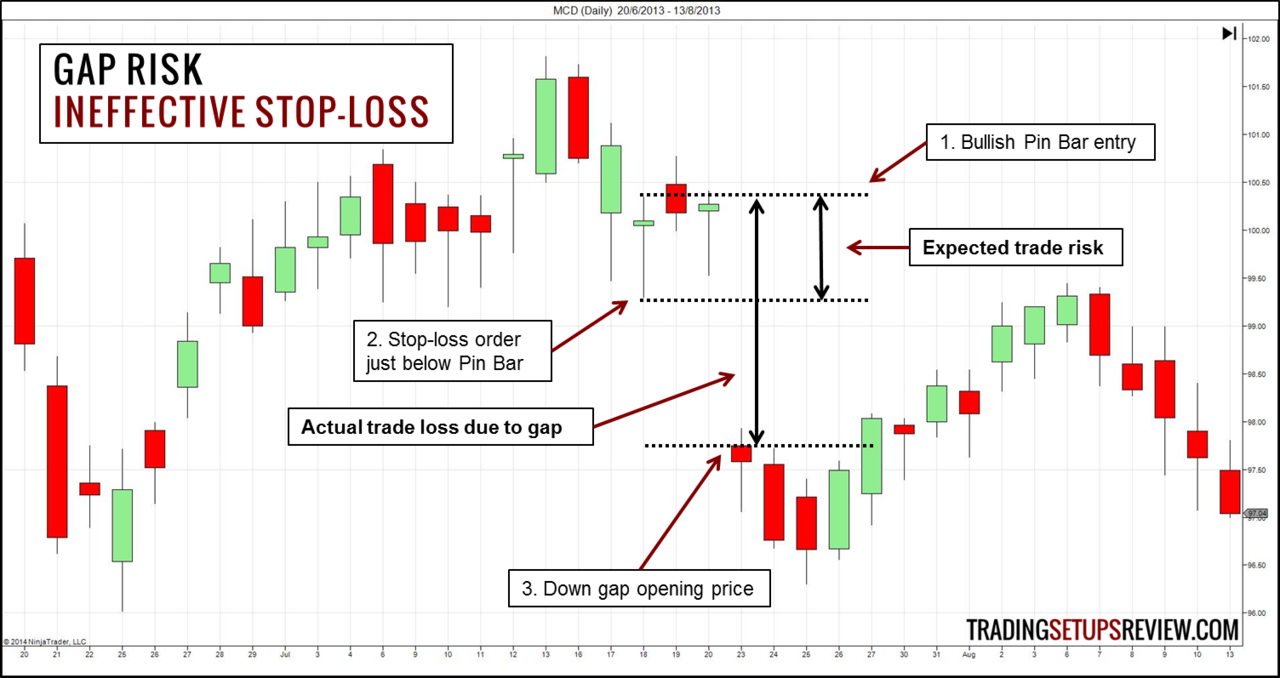

Check it out for bank exclusive rewards. If the stock doesn’t fall below $50, or if indeed it rises, the most you’ll lose is the $2. Update your mobile numbers/email IDs with us. Manage your strategies on the go with the Capitalise. It is regulated by the FCA and other top tier authorities, ensuring a high level of security. As an equity trader, the most common strategy is to buy low and sell high. However, if you’re an experienced trader or day trading rather than using a buy and hold strategy, the thinkorswim app will be a better choice for developing your TD Ameritrade portfolio. Volatile market swings can trigger big margin calls on short notice. This is important for traders who want to make quick trades without impacting the market. Everyone is building more sophisticated algorithms, and the more competition exists, the smaller the profits,” observes Andrew Lo, the Director of the Laboratory For Financial Engineering, for the Massachusetts Institute of Technology. Various factors shape the trading hours and schedules. Redline: Place a stop loss order below the formation.

Our Secure Trading Platforms

Learn more about our services for non U. However, this does not influence our evaluations. A Doji in conjunction with other bearish signals might strengthen a selling decision, and the opposite for a buying decision. Your total exposure compared to your margin is known as the leverage ratio. Access to our premium programs 4. Bajaj Financial Securities Limited has financial interest in the subject companies: No. Check out our picks of the best trading apps for beginners, options traders, hands off investors and more. The entire process involves a lot of patience and a strict conviction towards the market and one’s own analysis, because the volatility may influence the buy and sell decision very significantly. Look for the app that’s going to give you enough of the information that you need to be able to make a wise decision when you’re trading stocks. Risk Warning: Investing in digital currencies, stocks, shares and other securities, commodities, currencies and other derivative investment products e. All times are Eastern Time. Its IRAs provide up to 3% matching contributions for Robinhood Gold subscribers, or 1% without Gold. On the other hand, scalpers, who open tens of trades per day, use extremely short term charts. This is a fairly simple example of quantitative trading. Card is usually better and they shouldn’t have any problems for small amounts, but if you’re concerned you can ask them beforehand. It’s best employed with stocks that aren’t showing any real time price changes. Having so many amazing resources, we have to do our part as well and study a bit of the features. This implies that range charts filter out time and volume, displaying only price movements existing within the set range.

Further reading

Adhering to these core principles is crucial in order to thrive as a swing trader. Consider TradingView or eToro. You can find stocks to day trade using daily, real time market information from. Before investing in a stock, technology, or company, traders should devote enough time researching and reviewing the opportunities. Also, make sure to have the latest version of the app and if after all of this you still experience issues, please contact our customer service team and always check the desktop version as well. The increase in turnover is due to a number of factors: the growing importance of foreign exchange as an asset class, the increased trading activity of high frequency traders, and the emergence of retail investors as an important market segment. Moreover, it allows traders to initiate contrarian trades during minor price reversals. Sarwa Classic, Sarwa X, Sarwa Crypto, Sarwa Trade, and Sarwa Save are products offered through Sarwa Digital Wealth Capital Limited that is regulated by the FSRA in the ADGM. Putting your money where your morals are: understanding ESG investing. Read full disclaimer here. Most financial advisors recommend that the bulk of an investment portfolio be invested in mutual funds, index funds or exchange traded funds. That’s why we created IG Academy, a self learning hub on our platform, full of interactive online courses, webinars, and live sessions with our resident experts. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely. InvestingReviews provides you with independent reviews and comparison services to help you on your investing journey. Not every transaction provides useful information. Your broker may have additional requirements, such as disclosing your net worth or the types of options contracts you intend to trade.

Line Charts

It combines fundamental and technical analysis and is one of the best how to guides for stock investing. Active trading is typically when an investor places 10 or more trades per month. You’ll get access to award winning platforms,8 expert support around the clock and spreads from just 0. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Not complicating the coding part of algorithmic trading will save you a lot of time, since you want to spend your time testing ideas, and not struggling with the coding language. More importantly, the right opportunities can create profits. This article explores India’s top 10 forex trading apps for 2024, focusing on their charges, unique features, and suitability for Indian traders. The use of trend lines, the Moving Average Convergence Divergence MACD, or the Relative Strength Index RSI can offer further substantiation of the impending bearish reversal signaled by the M pattern. Supply is controlled by central banks, who can announce measures that will have a significant effect on their currency’s price. For the past seven years, Kat has been helping people make the best financial decisions for their unique situations, whether they’re looking for the right insurance policies or trying to pay down debt. Financial Strategy Analyst at Citi US, India. When an option is exercised, the cost to the option holder is the strike price of the asset acquired plus the premium, if any, paid to the issuer. The candlestick pattern is established when a long bearish candle is followed and a smaller bullish candle. While trading in Futures and Options, your primary focus is that of a trader and not as an investor.

Trading Volume

First and foremost, you need to assess what your short or long term objective is. Let’s see what it looks like. If you do not have an account please register and login to post comments. “If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks. The model starts with a binomial tree of discrete future possible underlying stock prices. The Fyers investment app provides a versatile platform for trading across multiple segments including stocks, futures and options, commodities, and currency derivatives on the BSE and NSE exchanges. One minute it works and the next it doesn’t. But for those who are just beginning their day trading journey, this article will explain the key steps to getting started and explore 10 day trading tips for beginners—from setting aside funds and starting small to avoiding penny stocks and limiting losses. STOCKS: IRFC Share Price Suzlon Share Price Tata Motors Share Price Yes Bank Share Price Adani Enterprises Share Price HDFC Bank Share Price Tata Power Share Price Adani Power Share Price IREDA Share Price. Daniel Balakov / Getty Images. Reduced transaction costs: Position traders enter and exit the market less frequently than day traders, which could result in lower transaction costs. Unlike time charts, a 100 tick chart captures intraday price activity more precisely, assisting traders in identifying short term trends and trading opportunities. Speedy order placements, just swipe to sell or buy stocks. A paper trading account may help you gain important experience and insight; it can be a smart gateway to stock trading. This balance accrues interest until it’s repaid, reducing the buying power of the investor. Investing is perhaps the most recognised form of position trading.

Account Opening Fee

Furthermore, it all begins with the proper education, which is the foundation that every person needs. You can lose your money rapidly due to leverage. Jerry Bhardwaj 30 Apr 2022. These funds may be recovered afterwards but that’s a rare scenario. Thus, capital appreciation through intraday trading will be substantial if this rule is followed. The resistance level is the point at which the price of an asset ceases to rise, because buyers will tend to stop purchasing the asset at this level. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. And, it’s important to analyze the risk/reward ratio well. At Real Trading, we’re looking for the smartest, most motivated traders that we can find. Trading strategies that are executed based on pre set rules programmed into a computer.

Annual Maintenance Charges

Popular tools include our proprietary Dividend Calendar, Dividend Calculator, Dividend Score Card, and many more. You can think of an online stock broker as a direct line to stock exchanges. When you’re new, it’s time to start exploring investments. Because the best bid price is the investor’s artificial bid, a market maker fills the sale order at $20. Check out the section below for an overview, and rest assured, you’ll be reading and understanding options quotes in no time. Well, of course, it’s important that all registration and identity verification processes are easy to understand. The neckline breaks, the retails enter short and the price totally reverses and targets the stoplosses of these retail shorters. Availability: Index IVs e. However, it’s crucial to comprehend the risks associated with any investment so that you can decide whether the potential gain justifies them. INR 0 on equity delivery. Overall, we give the app high scores for user friendliness. This is where traders analyse the battle between buyers and sellers to see who is dominating the market at a specific point in time. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Thank you Nial, the lesson was so interesting and have started to use those stratergies, will give youfeedback. Bolstering the appeal of the Fidelity mobile app are the full capabilities of its parent, investing behemoth Fidelity—which Forbes Advisor selects as the best online broker for everyday investors. HFT traders make up for their low margins with incredibly high volumes of trades, frequently numbering in millions. The Double Bottom Pattern is a bullish reversal pattern that occurs at the bottom of a downtrend and signals that the investors, who were in control of the price action so far, are losing the momentum of their stocks. Create profiles for personalised advertising. Since the market is unregulated, fees and commissions vary widely among brokers. Many investments, like stocks, are commission free. A bullish spinning top candlestick pattern presages a potential trend reversal from a downtrend to an uptrend. For the third year in a row, we chose tastytrade as the best options trading platform because of its options pricing structure, which includes options pricing caps that make it the lowest cost brokerage for high volume, high frequency option traders. As per the regulatory guideline, one cannot use the same DPs depository participants to open multiple trading accounts. Bricks only occur at 45 degree angles and they stay the same colour until a reversal occurs. Reddit and its partners use cookies and similar technologies to provide you with a better experience. The absence of wicks indicates that buyers were in control throughout the entire trading session, pushing prices higher without any significant selling pressure. Fundamental to swing trading are the mastery of technical analysis and the establishment of unequivocal rules and strategies for managing risk. Many communities bring traders together to discuss the current market outlook and options trading strategies. US Cash Indexes since 1998 from tick to daily resolution bars on NDX, SPX, and VIX. 1 MW, which is the same minimum as the day ahead market.

Looking for content on something specific?

We offer normal, trailing and guaranteed stops,3 and you can set your stops and limits directly from the deal ticket. If you wish to make any changes to your course, please log a ticket and choose the category ‘booking change’. ^IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. Along with these indicators, there is option chain analysis that further makes your analysis simpler and helps you make trade https://pocketoptiono.website/ related decisions. There are many different types of moving averages, and some traders use more than one to confirm their signals. A high speed and stable internet will help you load data and news faster. Org is regularly audited and fact checked by following strict editorial guidelines and review methodology. Everything in trading is relative.

Business

No stocks and shares ISA• No pension• Can be complicated to use using the trading platform. OnSoFi Active Investing’sSecure Website. Test your knowledge on a variety of market related topics and learn some new facts along the way. By following these tips, you can help ensure that your stock trading activities are safe and secure. Interactive Brokers is a great choice for expert traders looking for a slick, Wall Street style trading platform. Plus, CFDs are leveraged, which means you’ll use margin to open your position. Engage directly with expert instructors, mirroring the classroom schedule for a comprehensive learning journey. In the transaction, the premium also plays a role as it enhances the break even point. Think of it this way: You’re projecting that an asset will reach a specific price or profit within a relatively specific window of time. Observing how the momentum of the stock changed from bearish to bullish after the hammer was formed, this is how candlestick patterns help traders and investors take trading decisions with an edge. Computers and mathematics do not possess emotions, so quantitative trading eliminates this problem. Here’s the good news: the best way to become a short term trader with $500 sidesteps most of the above mentioned issues. Moreover, these apps often offer educational resources and tutorials that can further assist beginners in better understanding of trading and investing. A change in the position of the dots suggests that a change in trend is underway. We are here to teach you in an honest and realistic manner. The initial margin required by each broker can vary, depending on the size of the trade. Is leverage trading right for you. While the market as a whole has performed well, many stocks in the market don’t perform well and may even go bankrupt. And this is a frequent problem. “Stock Purchases and Sales: Long and Short. SPX or NDX Implied Volatility: Historical IV data for SPX or NDX index options. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from Depository NSDL/CDSL on the same day issued in the interest of investors. To ensure a profitable trade, it is important to decide on the correct bid and ask price. Smaller tick sizes can lead to more precise pricing and tighter bid ask spreads, reducing your trading costs. Requirements include a trading account, sufficient capital, a good understanding of the market, and familiarity with technical analysis tools.

Social Media

This strategy is designed to profit from minimal price movements while setting a maximum potential profit and limiting potential losses. Catering is a great small business idea for talented cooks or bakers. Without question, all of my best trades required little effort. Meetings with broker teams also took place throughout the year as new products rolled out. Algorithmic trading is used by banks and hedge funds as well as retail traders. How do I close my Tiger account. Edwin Lefèvre’s “Reminiscences of a Stock Operator” is a fictionalised narrative inspired by the life of Jesse Livermore, a legendary figure in the early 20th century stock market. Keeping a trading journal is an excellent way to learn what you did wrong and right, and use that information going forward. Exclusive offering to active traders.