Article summation

- A thread founder will act as a mediator between your home loan applicant therefore the financial institutions, helping the candidate inside compiling one selection of paperwork, then submitting they to all the big finance companies on their behalf.

- Bond originators contrast also offers off to 7 banking institutions in check to obtain the home customer a knowledgeable offer to their thread.

- Bond originators is repaid a fee by the lender, very the solution is free to your mortgage applicant.

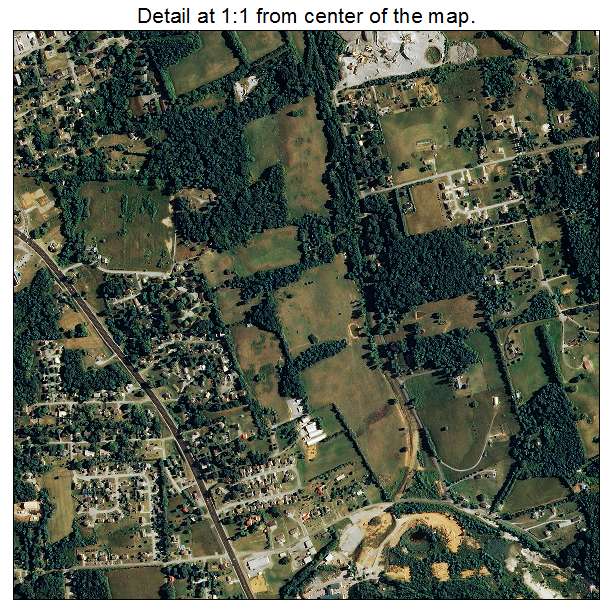

Who wants to university themselves in percentages and you may amortisations and you can securitisations whenever discover more inviting research to play such as opting for loans Sylvan Springs cloth swatches and light fixtures? Prior to you could potentially strike Builders so you’re able to fabric this new decorate section you ought to get the right resource for your new house.

What is a bond creator?

Once the term implies, the fresh character of your own bond originator is to procure a thread for you. It basically try to be an intermediary anywhere between both you and financial institutions, working out for you for the compiling one to number of records, immediately after which distribution the home application for the loan to all the big banking institutions for you.

Remember that i said banks’ rather than bank’, that’s important, since bond inventor does not run using behalf of any unmarried lender, but rather as a different agent whose goal is to get a knowledgeable offer due to their customer. So it provides them new freedom to make use of so you can to eight banks.

Why you need to explore a bond creator

- So much more choice: A bond creator will seek a deal that meets your need. Thus giving use of a large set of financing alternatives instead of you being required to do any of the legwork. A bond founder is a highly of good use spouse towards earliest-go out homebuyer, claims ooba mortgage brokers President Rhys Dyer, who shows you these particular thread positives usually determine your debts included in an excellent demands analysis’, and you will suit your standards in order to a variety of financing regarding banking institutions and other creditors; managing the process through to payment.

- Better prices: Brand new agent are certain to get entry to financing costs together with charge and you can fees in the their unique fingertips so it is easier and come up with a simple apples in order to apples’ research away from mortgage costs.

- Referring to financial institutions: Professionals also provide an effective dating that have banking companies, and can usually discuss an incredibly competitive speed. Financial institutions receive way too much business using thread originators very its in their welfare to be hired directly with them.

- Reduced paperwork: Going through a bond inventor function your done singular put out of papers that your particular mortgage expert upcoming submits to all the big banks. If you decide to go-about obtaining a home loan in place of a bond inventor, you would have to done and you will submit some documents to have per lender.

- Helpful advice: The fresh new consultant’s knowledge of your house-mortgage industry will help you create told conclusion and invite you to feel pretty sure on the procedure.

- It’s free! An informed reports is you don’t have to pay their thread inventor. As an alternative, they discover a percentage on financial with the fund they accept.

Why ooba lenders?

Southern area Africa’s best mortgage research provider, ooba mortgage brokers, has actually an effective a relationship with all of the nation’s greatest financial institutions, establishing all of them in the primary reputation to compare financial costs and provide an informed contract. Lenders is their just team, hence the higher rate of success in terms of getting securities recognized (ooba lenders had been successful in the protecting financial resource for one in virtually any three software that will be initial refused of the a lender).

Furthermore, ooba lenders makes the real estate processes simpler by offering a range of financial calculators which can help you determine what you really can afford. Start with ooba home loans’ free, on the internet prequalification product, the latest ooba Thread Sign. Upcoming, once you have located a home that meets your requirements, you could make an application for a mortgage.