FHA Provide Financing Guide simplifies the road so you can homeownership because of the detailing strategies for present finance to suit your down payment. They covers everything from that will present you money towards the details of gift emails, deciding to make the FHA loan techniques obvious and you can manageable. Ideal for basic-day customers, this article can be your key to an easier property journey.

Preciselywhat are FHA Current Money?

FHA Gift Financing try a true blessing for the majority basic-date homebuyers or people as opposed to a hefty savings account. Basically, these are financial presents accustomed coverage the brand new downpayment or closing costs into the an FHA financing. FHA, or Government Construction Administration, loans is common while they make it lower credit scores and you may faster down payments than of a lot old-fashioned finance.

Provide loans can come off a relative, a close friend, otherwise a charitable organization, deciding to make the dream about home ownership far more accessible for almost all. The best part? That isn’t a loan. You don’t have to pay it off! Thought somebody giving you an improve, stating, Here, let me help you to get nearer to owning your home. That is the heart behind FHA Gift Loans.

Trick Differences when considering Gift Money and you may Present Letters

- Provide Loans certainly are the real cash provided to this new homebuyer in order to help with the purchase.

- A present Letter was a document one to happens along with those funds. It is awesome important because they informs the lender that money is a real provide rather than financing that should be repaid. The fresh new page comes with info such as the quantity of the brand new gift, the connection between the giver in addition to individual, and you can a statement you to no cost is anticipated.

This new present letter feels like a good handshake in writing, making certain everyone involved knows it’s a good present, perhaps not one more financial obligation for the homebuyer.

How do FHA Present Fund Performs?

FHA Current Funds ease the burden off looking for a large number of money initial to acquire property. This is how they seamlessly fit into our home to find techniques:

- Looking a nice Donor: In the first place, you want some one ready to present the financing. Contemplate, it offers as a bona-fide provide, and no assumption out of cost.

- Gift Page: Your own donor will have to provide something special page. That isn’t just a casual notice. Its an official document one traces the nature of current and you will reassures your financial that the funds really are a gift.

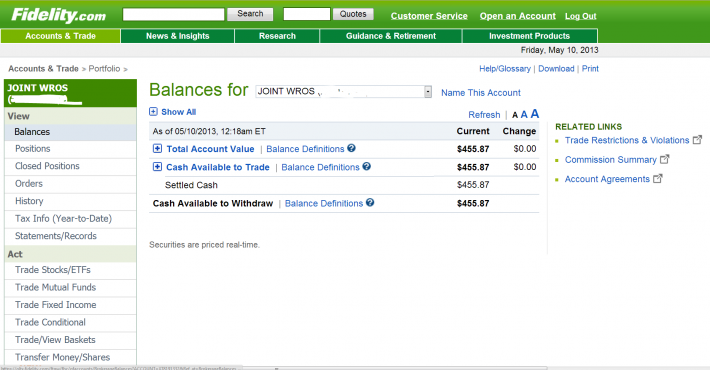

- Import of Funds: The income then must be moved to your. This is through consider, cord transfer, or even dollars, providing you safely document the order.

- Proof into the Financial: The lending company need to see that the money can be found in your bank account and you will originated in the source stated in brand new current page. Lender statements or purchase receipts always do the trick.

- By using the Fund: Once everything is in place, you should use brand new present money towards your advance payment otherwise settlement costs, somewhat reducing the sum of money you ought to remove out-of your own offers.

The good thing about FHA Current Financing is founded on the community heart someone helping a separate achieve homeownership. Its an easy techniques, deciding to make the path to to order a house a bit less steep.

FHA Provide Fund Guidance

Regarding FHA Present Financing, there are particular rules to ensure everything is clear and you will over panel. These pointers are designed to include both the bank additionally the buyer. Here is what you have to know:

- Way to obtain payday loans Fraser Funds: It is crucial that the supply of the provide financing is going to be verified. Lenders have to ensure that the provide try legitimate and you will legal. It indicates in depth paperwork is crucial.