Otherwise, it’s close to the top-of-the-line systems, such as our Editors’ Choice-winning tools Certify and Rydoo. There are several other issues that differentiate Receipt Bank from others. For example, while the software flags some issues, such as incomplete submissions, it does not automatically flag policy violations.

Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased. Patriot Software headquartered in Canton, Ohio offers Patriot PAY, their benefits administration and payroll software. Businesses with strong “We do it this way!” mindsets might be put off by some things, such as its flat and occasionally confusing approval hierarchy. In addition, quirks such as the inability to create an expense without a receipt or to return a problematical expense for correction can make things more awkward than necessary.

Extract every line of data with market leading accuracy, sort it by supplier and store it safely for you and your clients to access. We make accountants, and the businesses you advise, more productive, profitable and powerful with better data and insight. It also appeals to modern, growth-focused companies looking to leverage cloud-based solutions.

Features

Users also have the option to backup receipts to Dropbox and integrate with Quickbooks Online, ensuring seamless attachment of receipts to the appropriate transactions. Additionally, the app helps manage expenses by sending notifications and automatically preparing expenditure data for integration with Xero. Receipt Bank eliminates the hours small businesses waste on manual data entry, reconciliation, and tracking for paper receipts and invoices. By automatically extracting key details from receipts and invoices, it saves accounting teams significant time.

Automates Manual Tasks

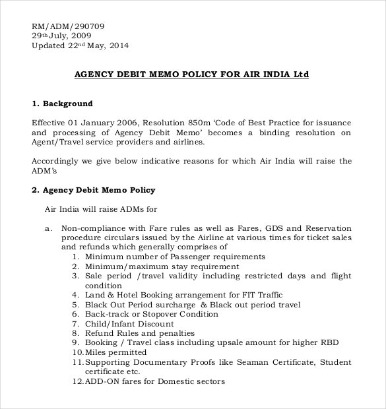

There’s also payroll integration with KeyPay and PaySuite, and yet more integration with billing and invoicing services, including Gusto ($25 Per Month at Gusto) and Bill.com. Real estate agencies have diverse expenses like marketing, services, supplies, and more. By automatically capturing and coding receipts, Receipt Bank makes it easier for agencies to track vendor spend. By centralizing documents and extracting key data, Receipt Bank enables streamlined financial processes and informed business analysis for small firms. Users don’t have to submit or create “trip to New York” collections; an office admin can assign receipts to a report on their behalf. You also can grant access to your accountant or bookkeeper in order to add new items, edit items, extract, or push data from your account.

Other Software Used

Manual receipt and invoice processing can be hugely time consuming for small businesses. Solutions like Receipt Bank aim to automate much of this work to boost finance team productivity. It’s also a practical solution for business travelers who need to track expenses accurately. Integrations with iOS, Android, and Windows phones allow easy capturing of receipts on-the-go.

With Dext Prepare expanding into different software solutions in the near future, we’re excited to see how it will interconnect products. There isn’t a way to receive support via telephone, so users are restricted to messaging within the Dext Prepare mobile or web apps or sending an email. Because of this, users have reported challenges connecting with customer traditional vs contribution margin income statement definition meanings differences support, with response times varying depending on the chosen method. Dext Prepare’s workspace is easily understandable and isn’t intimidating for first-time users. Its tabular-style format is neat and doesn’t look cramped, making it easy to read. You can also reorder the items by user, date, supplier, category, and total.

- Sorting through piles of crumpled receipts and keeping everything organized is a common pain point.

- This saves time and improves data accuracy, making reconciliation tasks easier.

- Solutions like Receipt Bank aim to automate much of this work to boost finance team productivity.

- They can test out features like automated data extraction, reporting, and accounting software integrations at no cost.

Our comprehensive Dext Prepare review aims to help you decide if the tool fits your business needs. Many small businesses rely gross vs net income on paper receipts and invoices to track expenses, which can be extremely time consuming and prone to errors. Sorting through piles of crumpled receipts and keeping everything organized is a common pain point. Receipt Bank integrates directly with leading small business accounting platforms like QuickBooks Online, Xero, and Sage. The solution is suitable for all types of small businesses from retailers to professional service firms.

The software is considered worth the price and the time investment to learn, making it a viable option for business owners. Users advise not overthinking but rather looking at the overall benefit and time savings when considering this software. To learn more about its features, users recommend trying the free trial version and watching YouTube videos. Additionally, users suggest getting a guided demo and speaking to the company about pricing options to get the most value out of this great product. Receipt Bank is an foreign exchange gain accounting software solution designed to help businesses streamline bookkeeping and financial reporting. It specializes in automating data extraction and categorization from receipts and invoices using optical character recognition (OCR) technology.