The newest Axis Financial loan EMI Calculator considers the borrowed funds amount, interest, and period to offer a quotation of your monthly EMI. Because of the typing these records to your calculator, you should buy a sense of simply how much might have to spend per month to settle your loan. Continue reading “Advantages of choosing the latest Axis Bank loan EMI Calculator”

I’d perhaps not irritate attempting to turn on people financing otherwise home loan makes up about getting

For a couple weeks now, to possess my Pennymac home loan membership, I was researching a great CC-569 mistake when updating (one-step posting) to help you obtain deals/revise recommendations.

Sadly, once deactivating the net properties, I cannot continue with Step 8 of your tips (Towards the Online Attributes tab, click on the Setup Now button.) while the On the web Properties loss has stopped being offered.

Are other users feeling equivalent products? Could there be a resolution on the modify mode incapacity having Pennymac financial profile offered?

Answers

Earliest, I would recommend wanting to are the PennyMac account(s) straight back via the Add Membership (+) route. Ahead of doing this, can you notice discussing an excellent screenshot of your tabs that are available inside register? If needed, please make reference to this group FAQ having information on precisely how to attach good screenshot. Rather, you are able to pull and drop screenshots towards response if the you aren’t given the substitute for incorporate accessories. And remember so you can redact people information that is personal as needed.

Thank you for your own comments. This new Pennymac Membership isnt moved, it’s just not synching any further having Pennymac. I’m hence reluctant to Create Account, as I shall get rid of records as well as the connected house. I would personally as an alternative ‘repair’ the partnership.

Pennymac CC-569

And i am pasting underneath the One step Up-date Summary “Requires Interest” content, and you will steps adopting the “Remedy it” roadway. So it street also results in weak to get in touch and therefore is not useful. Continue reading “I’d perhaps not irritate attempting to turn on people financing otherwise home loan makes up about getting”

Very servicers choose stonewall borrowers and you will foreclose on them, no matter if this sacks investors with enormous losses

“The newest trader losings is quite large, although servicer usually typically work for because of the completing a property foreclosure sale,” published Valparaiso School Rules College or university teacher Alan White in a papers had written when you look at the January.

In February regarding the 12 months, on Baldwins planned to reduce their residence in order to property foreclosure into the ily these people were prequalified for yet another assistance program. The organization said it would postpone the newest property foreclosure to their domestic up until Summer 16 when you’re their residence is reappraised, but only if your family produced an entire $2,250 payment. Once again, Citi would not detail the latest terms of one upcoming relief, therefore the Baldwins got the latest NCRC’s guidance and you may declined to spend. 24 hours later, its local papers seemed a notice informing the whole urban area you to definitely their house could be foreclosed in mid-ily to the April 5, zero appraiser had come across to evaluate their home after an entire times, and you will Citi got fell of contact.

“The audience is in hopes that no-one happens and you will places tresses on the doors for the April 16,” Marilyn said. “They won’t eve let you started or take many house up coming.”

Plus the Treasury Department’s data, Alan Light might have been record a database off 3

While i entitled Citi to own feedback, a great spokesman told me the organization helped five off four upset consumers it serviced in the 2008, and claimed Citi’s “losings minimization achievements” outnumbered foreclosures from the more 10-to-1 in the initial 90 days out-of 2009. According to the Treasury, CitiMortgage have accompanied twenty-seven,571 modifications in Obama plan, in the fifteen percent of your own number of absolutely unpaid mortgage loans new organization properties you to definitely Treasury thinks qualify. Continue reading “Very servicers choose stonewall borrowers and you will foreclose on them, no matter if this sacks investors with enormous losses”

Those people to order otherwise refinancing a very costly assets may get recognized to have a beneficial jumbo loan through Eagle Mortgage loan

You could potentially comment and you will age-indication quite a few of your own closure data files in advance of probably your own closure fulfilling, and you may obtain them instead of printing all of them out.

The process might be reduced while also providing you with time for you remark everything together with your loan officer, in place of impact overwhelmed at the closure desk.

Eagle Real estate loan Mortgage Choice

- Mostly focused on house pick resource and also render refinance loans

- Financing designs is antique and you may government (FHA, Va, USDA)

- Promote fixed-rate mortgages and you can varying-rate mortgage loans when you look at the differing words

- Jumbo money and you may opposite mortgage loans can also be found

- Its loan officials are very well-educated towards offered downpayment advice (DPA) apps

You can aquire home financing supported by Fannie mae or Freddie Mac, otherwise a keen FHA mortgage, USDA loan, or Virtual assistant mortgage.

With regard to home buy funding, the financing officials are-trained on the of a lot advance payment direction (DPA) programs that can easily be available via your local otherwise state.

Eagle Mortgage loan states it’s many DPA solutions in order to help people end up being people, seeing that downpayment is often the greatest difficulty towards the homeownership. Continue reading “Those people to order otherwise refinancing a very costly assets may get recognized to have a beneficial jumbo loan through Eagle Mortgage loan”

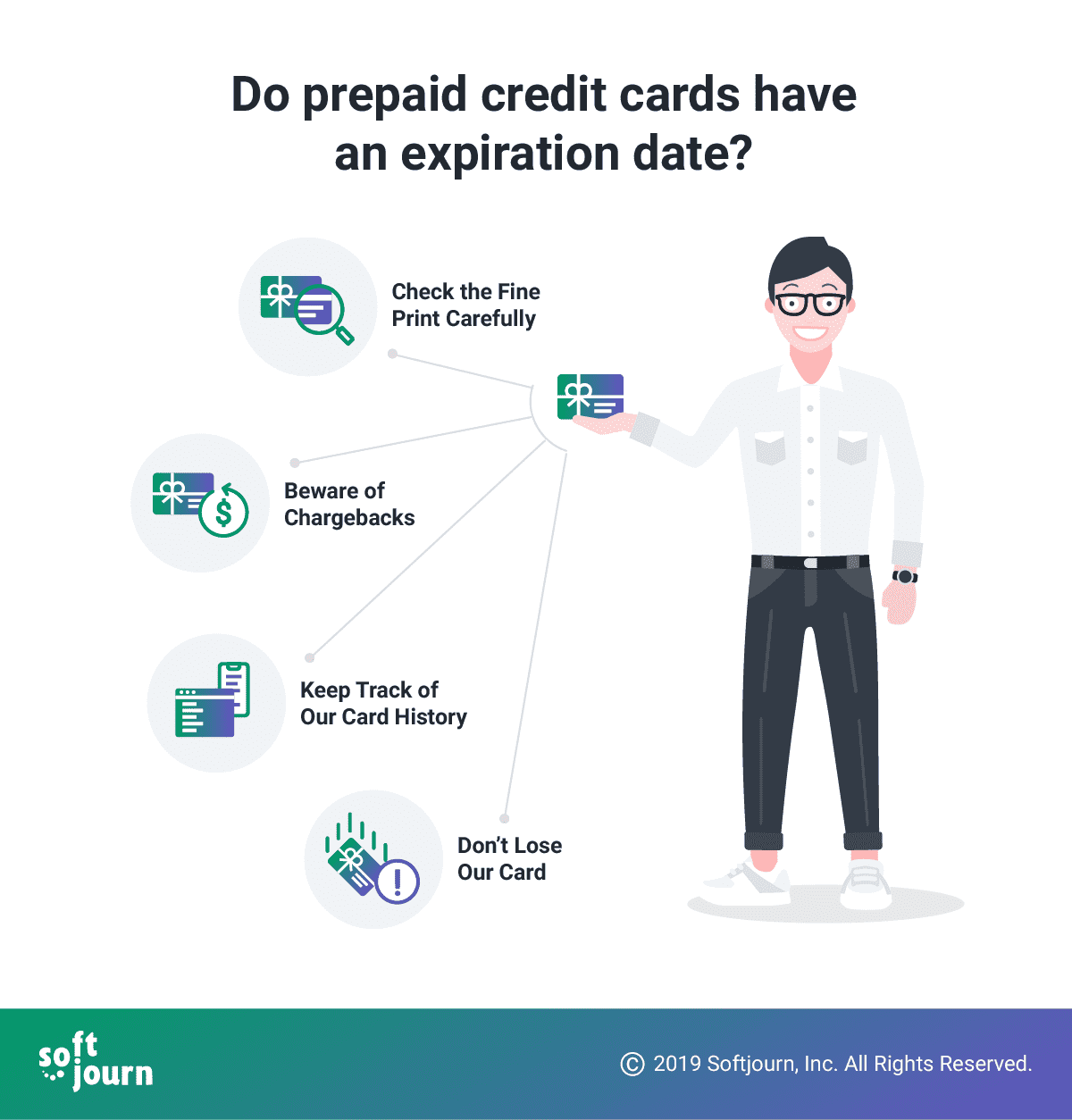

10.Exploring Different kinds of Credit [Modern Blog site]

– You can expose yourself to fraud and identity theft by sharing your individual and you may financial guidance with multiple lenders and creditors. For example, if you apply for credit online, over the phone, or by mail, you can risk giving your information to scammers who can use it to open fraudulent accounts in your name, make unauthorized purchases, or drain your bank accounts. To prevent this, you should always verify the legitimacy of the lender or creditor, use secure websites and devices, and monitor your credit report and bank statements regularly.

Therefore, diversifying your credit portfolio can be a smart strategy to reduce your credit risk and avoid defaulting on your loans, but it also requires careful planning, management, and monitoring. You should always consider your financial situation, needs, and goals before applying for any credit product, and compare the features, benefits, and costs of different options. You should also keep track of your credit usage, payments, and balances, and feedback your credit history and score periodically. By doing so, you can enjoy the benefits of diversification without compromising your monetary health and stability.

Regarding the area “Diversifying Your Credit Portfolio: Investigating Different kinds of Credit” in the post “Borrowing from the bank Exposure: How to reduce Your own borrowing from the bank chance and you will Change your Installment Feature Score,” i look into the fresh nuances out of diversifying your credit collection. Of the incorporating diverse perspectives and you can understanding, i make an effort to give complete info versus explicitly saying the fresh section title. Let’s speak about specific trick facts and you can concepts:

Unsecured Borrowing from the bank: Rather than protected credit, unsecured borrowing from the bank does not require collateral

1. Continue reading “10.Exploring Different kinds of Credit [Modern Blog site]”